Notice of

Annual Meeting

of Stockholders

2019

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ x

Filed by a Party other than the Registrant ☐o

Check the appropriate box:

| o | Preliminary Proxy Statement | |

| Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||

| x | Definitive Proxy Statement | |

| o | Definitive Additional Materials | |

| o | Soliciting Material under §240.14a-12 |

HEXCEL CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| Payment of Filing Fee (Check the appropriate box): | ||||||

| x | No fee required. | |||||

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||||

| (1) | Title of each class of securities to which transaction applies: | |||||

| (2) | Aggregate number of securities to which transaction applies: | |||||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||||

| (4) | Proposed maximum aggregate value of transaction: | |||||

| (5) | Total fee paid: | |||||

| o | Fee paid previously with preliminary materials. | |||||

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||||

| (1) | Amount Previously Paid: | |||||

| ||||||

| (2) | Form, Schedule or Registration Statement No.: | |||||

| (3) | Filing Party: | |||||

| (4) | Date Filed: | |||||

Notice of

Annual Meeting

of Stockholders

2019

|

Two Stamford Plaza 281 Tresser Boulevard Stamford, Connecticut 06901-3238 |

Notice of Annual Meeting of Stockholders |

Hexcel Corporation

Two Stamford Plaza

281 Tresser Boulevard

Stamford, Connecticut 06901-3238

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To be held on May 4, 20179, 2019

The Annual Meeting of Stockholders of Hexcel Corporation will be held in the Community Room, Two Stamford Plaza, 281 Tresser Boulevard, Stamford, Connecticut, on May 4, 20179, 2019 at 10:30 a.m. local time for the following matters:purposes:

| 1. | To elect |

| 2. | To |

| 3. | To |

| 4. | To vote on a proposal to ratify the appointment of Ernst & Young LLP as the company’s independent registered public accounting firm for |

| 5. | To transact such other business as may properly come before the meeting or any adjournments or postponements thereof. |

Stockholders

The Board of record atDirectors has fixed the close of business on March 9, 2017 will be13, 2019, as the record date for determination of the stockholders entitled to vote at the meeting andor any adjournments or postponements. A list of these stockholders will be available for inspection at the executive offices of Hexcel and will also be available for inspection at the annual meeting.postponements thereof.

By order of the Board of Directors

Gail E. Lehman Executive Vice President, General Counsel and Secretary

| ||

Dated: March 17, 201722, 2019

YOUR VOTE IS IMPORTANT. PLEASE SIGN, DATE AND COMPLETEWE ENCOURAGE YOU TO VOTE BY PROXY EVEN IF YOU PLAN TO ATTEND THE ANNUAL MEETING.

ENCLOSEDIMPORTANT NOTICE REGARDING THE

AVAILABILITY OF PROXY CARD AND RETURN IT PROMPTLY INMATERIALS FOR THE ENCLOSED

STOCKHOLDER MEETING TO BE HELD ON MAY 9, 2019

The proxy statement, annual report to stockholders and related materials are available on our website atPRE-ADDRESSED, POSTAGE-PAID, RETURN ENVELOPE.http://investors.hexcel.com/financials/proxy-materials.

i

ii

Hexcel Corporation

Two Stamford Plaza

281 Tresser Boulevard

Stamford, Connecticut 06901-3238

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

To be held on May 4, 2017

This proxy statement is furnished to the holders of common stock of Hexcel Corporation (“Hexcel” or the “company”) common stock, in connection with the solicitation of proxies by Hexcel on behalf of the Board of Directors of the company (the “board of directors” or the “board”) for use at the Annual Meeting of Stockholders, or any adjournments or postponements of the meeting (the “Annual Meeting”)thereof, to be held on May 4, 2017.9, 2019 (the “Annual Meeting”). This proxy statement and the accompanying proxy/voting instructionproxy card are first being distributed or made available to stockholders on or about March 17,22, 2019.

| HEXCEL CORPORATION | 2019 Proxy Statement |  |

This summary highlights selected information contained in this proxy statement. Please read the entire proxy statement carefully before voting your shares.

The Meeting

| TO BE HELD ON: | May 9, 2019 | |

| TIME: | 10:30 am, local time | |

| PLACE: | Community Room, Two Stamford Plaza, 281 Tresser Boulevard, Stamford, Connecticut 06901 | |

| RECORD DATE: | You will be eligible to vote your shares of common stock at the Annual Meeting if you were astockholder of record at the close of business on March 13, 2019. As of that date, 84,868,544shares of common stock were issued and outstanding. The holders of 42,434,273 shares willconstitute a quorum at the Annual Meeting. |

Proposals and Board Recommendations

| Proposal No. | Proposal | Board Recommendation | See Page | |

| 1 | Elect nine directors | FORall nominees | 1 | |

| 2 | Approve, on an advisory basis, 2018 executive compensation | FOR | 53 | |

| 3 | Approve an amendment to the Hexcel Corporation 2013 Incentive Stock Plan | FOR | 55 | |

| 4 | Ratify the appointment of Ernst & Young LLP as independent registered public accounting firm for 2019 | FOR | 65 |

| HEXCEL CORPORATION | 2019 Proxy Statement |  | i |

2019 PROXY STATEMENT SUMMARY

Company Highlights

Fiscal 2018 Performance

| n | Our sales were a record $2.189 billion in 2018, an increase of 11% compared to 2017. |

| n | Our diluted net income per common share was $3.11 for 2018, compared to $3.09 in 2017. |

| n | Our adjusted diluted earnings per share was $3.05 for 2018, as compared to $2.68 in 2017. Adjusted diluted earnings per share is a non-GAAP financial measure. See Annex A to this proxy statement for a reconciliation of adjusted diluted earnings per share to GAAP diluted earnings per share. |

| n | Our net cash provided by operating activities was $421.4 million in 2018, compared to $428.7 million in 2017. Our free cash flow, a non-GAAP financial measure, was a record $237.3 million in 2018, compared to $150.6 million in 2017. Free cash flow equals our net cash provided by operating activities minus capital expenditures ($184.1 million in 2018; $278.1 million in 2017). |

Corporate Governance Practices

We believe that our corporate governance practices generally reflect best practices consistent with Hexcel’s and our stockholders’ interests.

| ü | Eight of nine director nominees are independent |

| ü | Average age of director nominees is 60 |

| ü | Gender diversity reflected in the composition of the board |

| ü | Diversity of director experience, including in business background, technological acumen and tenure, reflected in the composition of the board |

| ü | Mandatory retirement age of 70 for directors |

| ü | Annual elections for all directors |

| ü | Independent lead director empowered with broad responsibilities and governance duties |

| ü | Majority voting in uncontested elections of directors |

| ü | One class of stock with equal voting rights |

| ü | Comprehensive enterprise risk, succession and business strategy oversight |

| ü | Regular executive sessions of the independent directors |

| ü | Annual board and board committee self-evaluations, and peer review of individual directors every other year |

| ü | Policies prohibiting hedging and pledging Hexcel stock by directors |

| ü | Robust stock ownership guidelines for directors |

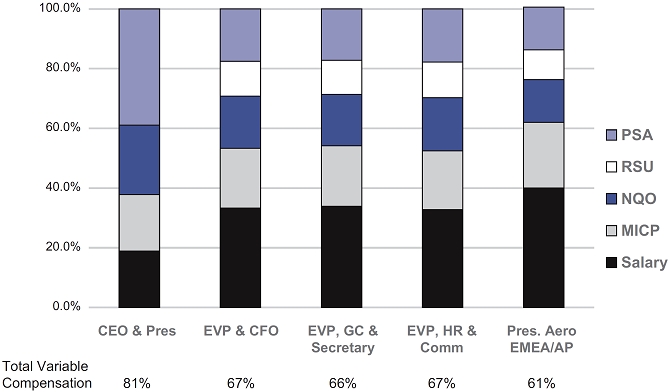

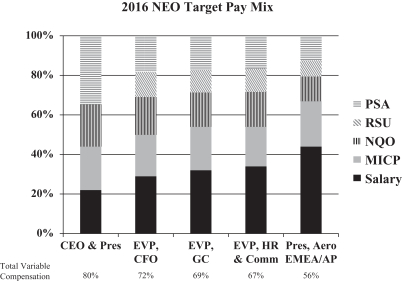

Executive Compensation

Our compensation philosophy is to deliver pay for performance, and we follow a number of compensation practices designed to provide a level of performance that creates sustainable value for our stockholders.

| ü | Annual say-on-pay stockholder vote |

| ü | Emphasis on performance-based compensation |

| ü | 81% of target CEO pay in 2018 was variable and at risk |

| ü | Non-guaranteed performance-based annual cash bonuses |

| ü | Challenging performance targets under annual cash bonus plan and long-term stock-based compensation plan based on return on invested capital and, since 2017, relative earnings per share growth targets |

| ü | Multi-year vesting periods for annual stock awards |

| ü | Limit on maximum incentive payouts |

| ü | No excise tax gross-up under severance agreements (subsequent to 2013) or under our Executive Severance Policy |

| ü | No repricing of any stock options without stockholder approval |

| ü | Clawback policy that applies to executive officer incentive-based compensation |

| ü | Policies prohibiting hedging and pledging Hexcel stock by executive officers |

| ü | Robust stock ownership guidelines for executive officers |

| ii |  | HEXCEL CORPORATION | 2019 Proxy Statement |

Who is entitled to vote at the Annual Meeting?

You will be eligible to vote your shares of common stock at the Annual Meeting if you were a stockholderholder of recordour common stock at the close of business on March 9, 2017. As of that date, 90,772,110 shares of common stock were issued and outstanding and such shares were held by 653 holders of record. The holders of 45,386,056 shares will constitute a quorum at13, 2019, the meeting.

record date. Each share of common stock that you hold will entitle you to cast one vote with respect to each matter that will be voted on at the Annual Meeting. All

What is the difference between holding shares as a stockholder of record and as a beneficial owner?

If your shares are registered directly in your name with our transfer agent, American Stock Transfer and Trust Company LLC, you are considered the stockholder of record or a “record holder” with respect to those shares, and you may submit a proxy card and vote those shares in the manner described in this proxy statement.

Most of our stockholders hold their shares as a beneficial owner through a broker, bank or other nominee rather than directly in their own name. If your shares are held through a broker, bank or other nominee, you are considered the “beneficial owner” of the shares. As the beneficial owner, you generally have the right to direct your broker, bank or other nominee on how to vote your shares. Your broker, bank or other nominee is responsible for providing you with a voting instruction form that you use to give instructions as to how your shares are represented by effective proxies that we receive in time to be voted shall be voted at the Annual Meeting. voted.

How do I vote?

Voting by proxy

If you direct how your votes shall be cast, shares will be voted in accordance with your directions. Ifwere a record holder on the record date, you returncan vote by returning a signed proxy and do not otherwise instructcard that provides your instructions as to how to vote on the proposals, then the shares represented by your proxy will be voted:

for each of the director candidates nominated by the board,

for approval of the company’s 2016 executive compensation,

in favor of our recommendation on the frequency of conducting an annual advisory vote on executive compensation,

in favor of the ratification of the appointment of Ernst & Young LLP as independent registered public accounting firm for 2017, and

in the discretion of the proxy holders on any other matters that may come before the Annual Meeting.

If you return a signed proxy with abstentions, your shares will be included in determining if a quorum is present.

A brokernon-vote occurs when a stockholder who holds his or her shares through a bank or brokerage firm does not instruct that bank or brokerage firm how to vote the shares and, as a result, the broker is prevented from voting the shares held in the stockholder’s account on certain proposals. Under applicable NYSE rules, if you hold your shares through a bank or brokerage firm and your broker delivers the Notice of Internet Availability or the printed proxy materials to you, the broker has discretion to vote on “routine” matters only. Of the matters to be voted on as described in this proxy statement, only the ratification of the selection of our independent registered public accounting firm is considered “routine” and therefore eligible to be voted on by your bank or brokerage firm without instructions from you. If you sign and return a voting instruction card to your broker, your shares will be voted as you instruct on the proposals described in this proxy statement and any other matters on which the proxy holder may properly vote. Shares subject to a brokernon-vote will be included in determining if a quorum is present.

We will pay all costs of preparing, assembling, printing and distributing the proxy materials. We have retained Morrow Sodali LLC, 470 West Avenue, Stamford, Connecticut, 06902, to assist in soliciting proxies for a fee of approximately $9,500, plus reasonableout-of-pocket expenses. Our employees may solicit proxies on behalf of our board through the mail, in person, and by telecommunications. We will request that brokers and nominees who hold shares of common stock in their names furnish proxy solicitation materials to beneficial owners of the shares, and we will reimburse the brokers and nominees for reasonable expenses they incur to do this.

If you give a proxy, you may revoke it at any time prior to the Annual Meeting by:voted.

mailing a revocation to Ms. Gail E. Lehman, the Secretary of the company, at the above address with a later date than any proxy you previously provided so long as it is received prior to the Annual Meeting;

submitting another properly completed proxy dated later than any proxy you previously provided so long as it is received by Ms. Lehman prior to the Annual Meeting;

by filing a written revocation at the Annual Meeting with Ms. Lehman; or

by casting a ballot at the meeting.

If you are an employee stockholder who holds shares through one of our benefit plans, you may revoke voting instructions given to the trustee for the applicable plan by following the instructions under “How to Vote Your Shares—Employee Stockholders” in this proxy statement.

Matters of Business, Votes Needed and Recommendations of the Board of Directors

Proposal 1—Election of Directors

Each outstanding share of our stock is entitled to one vote for as many separate nominees as there are directors to be elected. There are ten directors to be elected. The board has nominated Nick L. Stanage, Joel S. Beckman, Lynn Brubaker, Jeffrey C. Campbell, Cynthia M. Egnotovich, W. Kim Foster, Thomas A. Gendron, Jeffrey A. Graves, Guy C. Hachey and David L. Pugh for election to the board. Each of these ten nominees is currently a director of the company. Once a quorum is present, a majority of the votes cast in person or represented by proxy at the Annual Meeting and entitled to vote is required to elect each of the nominees for director. This means that each nominee must receive more votes “for” than “against” to be elected. Brokernon-votes and abstentions will be disregarded and will have no effect on the outcome of the vote.The board of directors recommends that you vote FOR the election of each of the board’s nominees for director.

Proposal 2—Advisory Vote to Approve Executive Compensation

Approval of the company’s 2016 executive compensation requires the affirmative vote of a majority of the shares present in person or represented by proxy and entitled to vote on the matter at the Annual Meeting once a quorum is present. In determining whether the proposal to approve 2016 executive compensation receives the required number of affirmative votes, abstentions will be counted and will have the same effect as a vote against the proposal. Brokernon-votes will be disregarded and will have no effect on the outcome of the vote. The vote is advisory andnon-binding; however, the compensation committee will consider the voting results among other factors when making future decisions regarding executive compensation.The board of directors recommends that you vote FOR the resolution approving the company’s 2016 executive compensation.

Proposal 3—Advisory Vote Regarding Frequency of Conducting an Advisory Vote on Executive Compensation

You may elect to have the vote on the frequency of conducting an advisory vote on executive compensation held annually, every two years or every three years, or you may abstain. You are not voting to approve or disapprove the board’s recommendation. Brokernon-votes will be disregarded and will have no effect on the outcome of the vote. The vote is advisory andnon-binding. The compensation committee will consider the outcome in recommending a voting frequency to the board of directors, but will not be bound either by its own recommendation or by the outcome of the vote, and may choose to conduct the vote more or less frequently in the future based on other factors, such as feedback from shareholder outreach programs, the adoption or revision of compensation policies, or the outcome of “Say on Pay” votes.The board of directors recommends that you vote FOR an ANNUAL shareholder advisory vote about compensation awarded to the company’s named executive officers.

Proposal 4—Ratification of Independent Registered Public Accounting Firm

Ratification of the appointment of Ernst & Young LLP to audit the company’s financial statements for 2017 requires the affirmative vote of a majority of the shares present in person or represented by proxy and entitled to vote on the matter at the Annual Meeting once a quorum is present. Abstentions will be counted and will have the same effect as a vote against the proposal. The audit committee is responsible for appointing the company’s independent registered public accounting firm. The audit committee is not bound by the outcome of this vote but, if the appointment of Ernst & Young LLP is not ratified by stockholders, the audit committee will reconsider the appointment.The board of directors recommends that you vote FOR the ratification of the selection of Ernst & Young LLP as the company’s independent registered public accounting firm for 2017.

Voting shares you hold through a broker, bank or other nominee

If you holdwere a beneficial owner of shares through someone else, such as a stockbroker,at the close of business on the record date, you may vote your shares by giving voting instructions to your broker, bank or

other nominee. Your broker, bank or other nominee you will receive material fromshould provide a voting instruction form that firm asking you for instructions onexplains how you want them tomay vote your shares. You canshould complete that firm’s voting instruction form and return it as requested by the firm. If the firm offers Internetinternet or telephone voting is offered, the voting instruction form willshould contain instructions on how to vote using those methods.

If you plan to attend the meeting

Please note that attendance will be limited to stockholders as of the record date. Admission will be on a first-come, first-served basis. If you attend the Annual Meeting, you will need to present valid picture identification, such as a driver’s license or passport. If you hold your shares through someone else, such as a stockbroker, bank or other nominee, you will need to show a brokerage statement or account statement reflecting your stock ownership as of the record date. Cameras, recording devices and other electronic devices will not be

permitted at the Annual Meeting. You may contact Morrow Sodali LLC at(800) 607-0088 to obtain directions to the site of the Annual Meeting. The doors to the meeting will open at 10:00 a.m. local time and the meeting will begin at 10:30 a.m. local time.

Voting in person

If you are a registered stockholder,record holder, you may vote your shares in person by ballot at the Annual Meeting. You should indicate that you plan to attend the Annual Meeting when submitting your proxy card by checking the box under the caption “Meeting Attendance” on the proxy card. Even if you plan to attend the meeting, we urge you to submit a proxy card so that your vote will be recorded in the event that you are unable to attend.

If you hold your shares inare a stock brokerage account or through a bank or other nominee,beneficial owner, you will notneed an admission ticket or proof of ownership to be ableadmitted to vote in person at the Annual Meeting unless you have previously requested and obtained a “legal proxy”Meeting. A recent brokerage statement or letter from your broker, bank or other nominee and present itare examples of proof of ownership. If you want to vote the shares you hold as a beneficial owner in person at the Annual Meeting, along withyou must bring a properly completed ballot.signed proxy from your broker, bank or other nominee giving you the right to vote the shares.

Employee stockholders

If you hold shares through our Employee Stock Purchase Plan or ourtax-deferred 401(k) savings plan, you will receive a separate voting instruction form to instruct the custodian or trustee for the applicable plan as to how to vote your shares. With respect to the 401(k) savings plan, all shares of common stock for which the trustee has not received timely instructions shallwill be voted by the trustee in the same proportion as the shares of common stock for which the trustee received timely instructions, except if that would beunless inconsistent with the provisions of Title I of ERISA.applicable law. With respect to our Employee Stock Purchase Plan, we consider all shares of common stock for which the custodian has not received timely instructions not present for quorum purposes, and those shares will not be voted by the custodian.

| HEXCEL CORPORATION | 2019 Proxy Statement |  | iii |

Inspectors2019 PROXY STATEMENT SUMMARY

What does it mean if I receive more than one proxy card or voting instruction form?

If your shares are held in more than one account, you will receive a proxy card or voting instruction form for each account. To ensure that all of Electionyour shares are voted, please follow the instructions you receive for each account to submit a proxy card or voting instruction form.

What is required in order to attend the Annual Meeting?

In accordance with our security procedures, admission to the Annual Meeting is restricted to record holders and beneficial owners of Hexcel stock as of the record date, March 13, 2019. If you are a record holder, indicate that you plan to attend the Annual Meeting when submitting your proxy card by checking the box under the caption “Meeting Attendance” on the proxy card. If you are not a record holder, or if you are a record holder and have not submitted your proxy card or did not indicate on your submitted proxy card that you plan to attend the Annual Meeting, please contact the office of the Corporate Secretary at Hexcel Corporation, Two Stamford Plaza, 281 Tresser Boulevard, Stamford, Connecticut 06901; facsimile number (203) 358-3972 to request an admission ticket. If you do not have an admission ticket, you must present proof of ownership in order to be admitted to the Annual Meeting. All stockholders attending the Annual Meeting must also present a valid government-issued photo identification, such as a driver’s license or passport, to gain entry to the Annual Meeting. Cameras, recording devices and other electronic devices are not permitted at the Annual Meeting. You may contact Morrow Sodali LLC at (800) 607-0088 to obtain directions to the site of the Annual Meeting. The doors to the meeting will open at 10:00 a.m. local time and the meeting will begin at 10:30 a.m. local time.

How does the board of directors recommend that I vote?

The board recommends that you vote:

| n | FORthe election of the nine director nominees; |

| n | FORthe approval, on an advisory basis, of the company’s 2018 executive compensation; |

| n | FORthe approval of an amendment to the Hexcel Corporation 2013 Incentive Stock Plan; and |

| n | FORthe ratification of Ernst & Young LLP as our independent registered public accounting firm for 2019. |

What if I return my proxy card but do not vote for all of the proposals?

All shares that are represented by a properly completed proxy card that we receive in time to be voted will be voted at the Annual Meeting. The persons designated on the proxy card as “proxies” (the “proxy holders”) will vote all shares covered by the proxy card in accordance with your instructions on the proxy card. If no instructions are given, the proxy holders will vote the shares in accordance with the board’s recommendations.

If any other matter properly comes before the Annual Meeting, the proxy holders will vote the shares in their discretion. If any director nominee becomes unavailable for election for any reason prior to the vote at the Annual Meeting, the board may reduce the number of directors to be elected or substitute another person as nominee, in which case the proxy holders will vote for the substitute nominee.

What is a “broker non-vote”?

A broker non-vote occurs when a broker holding shares for a beneficial owner does not vote on a particular proposal because the broker does not have discretionary voting power with respect to that proposal and has not received voting instructions from the beneficial owner. Under New York Stock Exchange (“NYSE”) rules, brokers are not permitted to vote on the election of directors, the advisory vote on the compensation of our named executive officers or the amendment to the Hexcel Corporation 2013 Incentive Stock Plan; therefore, if your shares are held by a broker, you must provide voting instructions if you want your broker to vote on these matters.

Can I vote by telephone or over the internet?

If you are a record holder, you can vote by returning a signed proxy card, providing instructions as to how your shares will be voted, or vote by ballot at the Annual Meeting. Telephone and internet voting is not available for record holders. If you are a beneficial owner, you should receive material from your broker, bank or other nominee asking you for instructions on how you want them to vote your shares. If the firm offers internet or telephone voting, the voting instruction form should contain instructions on how to vote using one of those methods.

| iv |  | HEXCEL CORPORATION | 2019 Proxy Statement |

2019 PROXY STATEMENT SUMMARY

How do I revoke a proxy?

If you are a record holder and have provided a proxy, you may revoke it at any time prior to the Annual Meeting by:

| n | mailing a revocation to our Corporate Secretary at Hexcel Corporation, Attention: Corporate Secretary, Two Stamford Plaza, 281 Tresser Boulevard, Stamford, Connecticut 06901, with a later date than the date of any proxy you previously provided, so long as the revocation is received by our Corporate Secretary prior to the Annual Meeting; |

| n | submitting another properly completed proxy dated later than the date of any proxy you previously provided, so long as it is received by our Corporate Secretary prior to the Annual Meeting; |

| n | filing a written revocation at the Annual Meeting with our Corporate Secretary; or |

| n | casting a ballot at the Annual Meeting. |

If you are a beneficial owner, you should contact your broker, bank, or other nominee for instructions on how to revoke your proxy or change your vote. If you are an employee stockholder who holds shares through one of our benefit plans, you should contact the trustee or custodian for instructions on how to revoke your proxy or change your vote.

What are the quorum and vote requirements?

A quorum of stockholders is necessary to hold a valid Annual Meeting. A quorum will exist if a majority of the outstanding shares of common stock entitled to vote at the Annual Meeting are present in person or by proxy at the Annual Meeting. As of the record date, March 13, 2019, 84,868,544 shares of common stock were issued and outstanding. The holders of 42,434,273 shares will constitute a quorum at the meeting.

The following table indicates the vote required for approval of each matter to be presented to the stockholders at the Annual Meeting and the effect of abstentions and broker non-votes.

| Required Vote | Effect of Votes, Abstentions and Broker Non-Votes | |||

| Proposal 1 — Elect nine directors | Number of votes cast “for” the nominee must exceed the number of votes cast “against” that nominee. | Abstentions and broker non-votes will have noeffect on the voting for this matter. | ||

| Proposal 2 — Approve, on an advisorybasis, 2018 executivecompensation | Affirmative vote of a majority of the shares of common stock present in person or represented by proxy and entitled to vote. | Abstentions will have the effect of a vote“against.” Broker non-votes will have no effecton the voting for this matter. | ||

| Proposal 3 — Approve an amendmentto the Hexcel Corporation2013 Incentive Stock Plan | Affirmative vote of a majority of the shares of common stock present in person or represented by proxy and entitled to vote. | Abstentions will have the effect of a vote“against.” Broker non-votes will have no effecton the voting for this matter. | ||

| Proposal 4 — Ratify the appointment ofErnst & Young LLP as independent registered public accounting firm for 2019 | Affirmative vote of a majority of the shares of common stock present in person or represented by proxy and entitled to vote. | Abstentions will have the effect of a vote“against.” There should be no broker non-votessince brokers are permitted to vote on thisproposal, even if they have not received votinginstructions from the beneficial owners. |

How may the company solicit my proxy?

We will pay all costs of preparing, assembling, printing and distributing the proxy materials. We have retained Morrow Sodali LLC, 470 West Avenue, Stamford, Connecticut 06902, to assist in soliciting proxies for a fee of approximately $10,000, plus reasonable out-of-pocket expenses. Our employees may solicit proxies on behalf of our board through the mail, in person, by telephone or by other forms of electronic communication, without additional compensation. We will reimburse brokers, banks and other nominees who hold shares of

common stock in their names for the expenses of furnishing proxy materials to beneficial owners of the shares.

How will the votes at the Annual Meeting be tabulated?

At the Annual Meeting, Morrow Sodali will count the votes.tabulate all votes cast in person or by proxy. Its officers or employees will serve as inspectors of election.

PROPOSAL 1—ELECTION OF DIRECTORS

| HEXCEL CORPORATION | 2019 Proxy Statement |  | v |

2019 PROXY STATEMENT SUMMARY

Where will I find the voting results on the proposals presented at the Annual Meeting?

We intend to announce the preliminary voting results at the Annual Meeting. We will publish the final voting results in a Current Report on Form 8-K that we will file with the U.S. Securities and Exchange Commission (“SEC”), generally within four business days following the Annual Meeting.

Several stockholders live at my address. Why did we receive only one set of proxy materials?

We typically deliver only one annual report and one proxy statement to multiple stockholders at the same address, unless we have received contrary instructions from one or more of the stockholders. We will, upon written or oral request, promptly deliver a separate copy of the annual report or proxy statement to a stockholder at a shared address to which a single copy of the annual report or proxy statement was delivered. Record holders who wish to receive a separate annual report or proxy statement in the future, or record holders sharing an address who wish to receive a single copy of the annual report or proxy statement in the future, should notify our company’s Corporate Secretary at Hexcel Corporation, Attention: Corporate Secretary, Two Stamford Plaza, 281 Tresser Boulevard, Stamford, Connecticut 06901. Beneficial owners who have the same address and wish to receive a separate copy of the annual report or proxy statement in the future should contact their broker, bank, or other nominee.

| vi |  | HEXCEL CORPORATION | 2019 Proxy Statement |

At the 2017 annual meeting, tenAnnual Meeting, nine directors will be elected to hold office until the 2018 annual meeting2020 Annual Meeting of Stockholders and until their successors are duly elected and qualified. All nominees identified in this proxy statement for election to the board are currently serving as directors of the company.

Shares represented by an executed and returned proxy card will be voted for the election of each of the ten nominees recommended by the board, unless the proxy is marked against any nominee. If any nominee for any reason is unable to serve, the shares of common stock represented by the proxy card may, at the board’s discretion, be voted for an alternate person that the board nominates. We are not aware of any nominee who will be unable to or will not serve as a director. Each of the nominees has consented to being named in this proxy statement and to serve if elected.

Majority Voting Standard for Election of Directors

Our Amended and Restated Bylaws provide for a majority voting standard for the election of directors in uncontested elections. Under this standard, which will apply to the election of directors at the Annual Meeting, a director nominee will be elected only if the number of votes cast “for” that nominee exceeds the number of votes cast “against” that nominee. Brokernon-votes and abstentions will be disregarded and will have no effect on the outcome of the vote. EachIf a nominee who currently is serving as a director is not re-elected, Delaware law provides that the director will continue to serve on the board. However, each incumbent director nominee standing for re-election must submit an irrevocable resignation in advance of the stockholder vote regarding the election of directors. This addresses the situation in which there is a “holdover” director who has not received the required number of votes forre-election, but who, in accordance with Delaware law, remains on the board until his or her successor is elected

and qualified. The resignation is contingent upon both the nomineedirector not receiving the required vote forre-election and the board’s acceptance of the resignation, which the board, in its discretion, may reject if it deems such rejection to be in the best interest of the company.

Prior to the board’s determination to accept or reject the resignation, the nominating and corporate governance committee, composed entirely of independent directors, will make a recommendation to the board with respect to the tendered resignation. In its review, the committee will consider those factors deemed relevant to the determination, and whether the director’s resignation from the board would be in the best interest of the company and our stockholders.

The board must take action on the committee’s recommendation within 90 days following the meeting at which the election of directors occurred. An incumbent director whose resignation is the subject of the board’s determination is not permitted to participate in the deliberations or recommendationvotes of the committee or the board regarding the acceptance of the resignation.

In the case of contested elections (a situation in which the number of nominees exceeds the number of directors to be elected)elected, which is not the case with respect to the election of directors at the Annual Meeting), a plurality voting standard will apply.

| HEXCEL CORPORATION | 2019 Proxy Statement |  | 1 |

PROPOSAL 1—Election of Directors

Information Regarding the Directors

All but one of our current directors have been nominated forre-election to the board. Dr. David HillL. Pugh has not been nominated forre-election because he has reached the age of 70 and, as stated in our corporate governance guidelines, it is no longer eligible to serve onour general policy that a director who has attained the board. Asage of 70 will not be nominated for re-election. Effective as of the date of the Annual Meeting, the number of directors will be reduced to ten.nine. The nominating and corporate governance committee considered the following attributes to concludein connection with its determination that our current directors other than Mr. Hill should continue to serve on our board: extensive familiarity with large-scale operations; industry expertise and professional relationships; the ability to utilize extensive past experience in management, finance, technology, and operations, and other areas to address issues we face on a recurring basis; collegiality and the ability to work together as a group; outstanding integrity and business judgment; and the ability to ask probing questions during board discussions and to carefully scrutinize significant business, financing and other proposals suggested by management. In addition to these factors, the committee also considered the respective attributes below:with respect to each nominee that are listed below that nominee’s biographical information:

| NICK L. STANAGE |

NICK L. STANAGE,Chairman, Chief Executive Officer and President

Age:58, director since 60

Director Since:2013

Position, Principal Occupation, Business Experience and Directorships:

Mr. Stanage became a director and President andour Chief Executive Officer and President on August 1, 2013, and also became our Chairman of the Board on January 1, 2014. He has served as our President since November 2009, and also2009. Mr. Stanage served as our Chief Operating Officer from May 2012 until assuming the Chief Executive Officer position. Prior to joining Hexcel, Mr. Stanage was President of the Heavy Vehicle Products group (including both Commercial Vehicle Products and Off Highway Products) at Dana Holding Corporation from December 2005 to October 2009, and served as Vice President and General Manager of the Commercial Vehicle groupGroup at Dana from August 2005 to December 2005. From 1986 to 2005, Mr. Stanage held positions of increasing responsibility in engineering, operations and marketing with Honeywell Inc. (formerly AlliedSignal Inc.) including:. Among the positions held by Mr. Stanage at Honeywell were Vice President Integrated Supply Chain and Technology for the Consumer Products Group from 2003 to January 2005, and Vice President and General Manager of the Aerospace Group’s Engine Systems and Accessories Division from January 2005 to August 2005. Mr. Stanage began his career as a design engineer with Clark Equipment Company. Mr. Stanage also serves on the board of directors of TriMas Corporation, as well as on the audit, compensation, and corporate governance and nominating committees of TriMas.

Key Attributes, Experience and Skills:

Mr. Stanage has developed anin-depth understanding of the company’s business operations, growth opportunities and challenges and its customer and product base during his seven-year tenure as President, Chief Operating Officer and his current role as Chairman, Chief Executive Officer and President. His over 20 years’

management and operations experience at Dana Corporation and Honeywell provide him with critical expertise in the management, financial and operational requirements of a global manufacturing company.

| Key Attributes, Experience and Skills: |

| Mr. Stanage has developed an in-depth understanding of our company’s business operations, growth opportunities and challenges, as well as its customer and product base during his nine-year tenure with Hexcel. His over 20 years of management and operations experience at Dana and Honeywell provide him with substantial expertise in the management, strategy, financial and operational requirements of a global manufacturing company. |

| JOEL S. BECKMAN |

JOEL S. BECKMANRetired Managing Partner,

Greenbriar Equity Group LLC, 61, director since

Age:63

Director Since:2003

Committees:Nominating and Corporate Governance, Finance (Chair)

Position, Principal Occupation, Business Experience and Directorships:

Mr. Beckman is a retired Managing Partner of Greenbriar Equity Group LLC, a private equity fund focused exclusively on making investments in transportation and transportation-related companies. Prior to founding Greenbriar in 2000, Mr. Beckman was a Managing Director and Partner of Goldman, Sachs & Co., which he joined in 1981. Mr. Beckman is on the board of a number of private companies, and is active in various civic organizations.

Key Attributes, Experience and Skills:

Mr. Beckman brings to his role on the board over 30 years’ experience as a banker and an investor in transportation (including aerospace) companies with both Greenbriar Equity Group and Goldman Sachs. In addition to Mr. Beckman’s valuable contributions related to the transportation sector, his experience in private equity led to his appointment

| Key Attributes, Experience and Skills: |

| Mr. Beckman brings to his role on the board over 30 years’ experience as an investment banker and an investor in transportation (including aerospace) companies. His experience in the transportation sector, together with his extensive experience in private equity, renders him well-qualified to serve as chair of our finance committee, a position he has held since January 2009, and has made him a key contributor to the board’s consideration of refinancing and capital structure matters. |

| 2 |  | HEXCEL CORPORATION | 2019 Proxy Statement |

PROPOSAL 1—Election of our finance committee and has made him a key contributor to refinancing and capital structure discussions since joining the board.Directors

| LYNN BRUBAKER |

LYNN BRUBAKERRetired Vice President/General Manager

Honeywell International Inc., 59, director since

Age:61

Director Since:2005

Position, Principal Occupation, Business ExperienceCommittees:Audit, Nominating and Directorships:Corporate Governance (Chair)

Ms. Brubaker retired in 2005 from Honeywell International Inc. (which acquired AlliedSignal in 1999),2005, where she had most recently served as Vice President/General Manager—Commercial Aerospace. Ms. Brubaker has held a variety of executive leadership, operational management, strategy, business development and customer management roles in the aerospace industry.industry, including a variety of positions at AlliedSignal Inc. from 1996 until AlliedSignal acquired Honeywell in 1999. Prior to joining Allied Signal,AlliedSignal, Ms. Brubaker held management positions with McDonnell Douglas, Republic Airlines (acquired by Northwest Airlines), and ComAir. Ms. Brubaker has been a director of FARO Technologies, Inc. since July 2009, and serves on its audit, compensation, operating,operational audit, and nominating and corporate governance committees. Ms. Brubaker also serves as anon-executive director of QinetiQ Group plc, a British company withwhose shares are listed on the London Stock Exchange, and serves on its remuneration, audit, risk & CSR and nominating and corporate governancenominations committees. Ms. Brubaker also currently serves on the board of a private aerospace company.

| Key Attributes, Experience and Skills: |

| Ms. Brubaker has over 40 years of experience in the aviation and aerospace industries, as well as over 17 years’ experience serving on several boards of directors, and 14 years advising international, high technology and multi-industry companies. In particular, her extensive experience in a wide variety of capacities with the commercial aerospace, defense and space industries enables her to provide valuable insights to the board with respect to these industries. In addition, her ongoing aerospace industry involvement and relationships enable her to provide important insights as to customer feedback independent of management, and her expertise in sales and marketing management enables her to provide valuable observations with regard to our sales and marketing organization. Ms. Brubaker’s extensive contacts within key markets for Hexcel, as well as her experience on the boards of other companies, make her well suited to chair our nominating and corporate governance committee, a position she has held since January 2014. |

| JEFFREY C. CAMPBELL |

Key Attributes, ExperienceExecutive Vice President and Skills:Chief Financial Officer

American Express Company

Ms. Brubaker is a seasoned executive with over thirty-eight years’ experience in the aviation

Age:58

Director Since:2003 (Lead Director)

Committees:Audit (Chair), Nominating and aerospace industries, as well as over fifteen years’ experience serving on various boards of directors, and 12 years advising international, high technology and multi-industry companies. Her extensive experience in the commercial aerospace, defense and space industries, in a wide variety of roles, makes her a valuable contributor to the board of Hexcel. Ms. Brubaker’s aerospace experience runs the gamut from operator to original equipment manufacturer to aftermarket parts and service provider. Her ongoing aerospace industry involvement and relationships provide the board with additional customer feedback independent of management. In addition, Ms. Brubaker has used her expertise in sales and marketing management to assess and advise our marketing and sales teams. Ms. Brubaker’s extensive contacts within key markets for Hexcel, as well as her experience on the boards of other companies, make her well-suited to lead our nominating and corporate governance committee.Corporate Governance

JEFFREY C. CAMPBELL, 56, director since 2003

Position, Principal Occupation, Business Experience and Directorships:

Mr. Campbell has served as Executive Vice President and Chief Financial Officer of the American Express Company, a global services company, since August 2013. From January 2004 to June 2013, he served as Executive Vice President and Chief Financial Officer of McKesson Corporation, a leading healthcare services, information technology and distribution company. Mr. Campbell was Senior Vice President and Chief Financial Officer of AMR Corp,Corp., the parent company of American Airlines, from June 2002 to December 2003, served as a Vice President of American Airlines from 1998 to June 2002 and held various management positions of American Airlines from 1990 to 1998. Earlier in his career, Mr. Campbell worked as a Certified Public Accountantcertified public accountant with Deloitte, Haskins & Sells from 1986 to 1988.

Key Attributes, Experience Mr. Campbell has been a director of Aon plc since March 2018, and Skills:

Asis a resultmember of Mr. Campbell’s extensive experience in financeits audit and accounting, including his current role as CFO of American Express, a $34 billion global services company,organization and his prior role as CFO of McKesson, a $100 billion healthcare services company, as well as over fifteen years in executive and management positions in the aerospace industry (American Airlines), he brings significant financial acumen to the board, providing valuable expertise and guidance in areas such as compliance, risk management, financing, investor relations and systems solutions. Mr. Campbell’s breadth and depth of experience in financial roles, including that of CFO of three multi-national, publicly traded companies, provides us with the financial expertise that is critical in the role of chair of the audit committee.compensation committees.

| Key Attributes, Experience and Skills: |

| Mr. Campbell’s extensive experience in finance and accounting, including his current role as Chief Financial Officer of American Express, and his prior role as Chief Financial Officer of McKesson, as well as over 13 years in executive and management positions in the commercial aviation industry, enable him to provide significant financial expertise to the board, particularly in areas such as compliance, risk management, financing, investor relations and systems solutions, and renders him well-qualified to serve as chair of the audit committee, a position he has held since May 2008. Mr. Campbell’s proven management expertise and tenure on the board led to his appointment as lead director in July 2018. |

| HEXCEL CORPORATION | 2019 Proxy Statement |  | 3 |

PROPOSAL 1—Election of Directors

| CYNTHIA M. EGNOTOVICH |

CYNTHIA M. EGNOTOVICHRetired President, Aerospace Systems Customer Service

United Technologies Corporation, 59, director since

Age:61

Director Since:2015

Committees:Audit

Position, Principal Occupation, Business Experience and Directorships:

Ms. Egnotovich served as President, Aerospace Systems Customer Service of United Technologies Corporation (“UTC”) from July 2012 to November 2013. Previously, Ms. Egnotovich served as Segment President, Nacelles and Interior Systems for Goodrich Corporation (which was acquired by UTC)UTC in July 2012) from 2007 to 2012. Ms. Egnotovich joined Goodrich in 1986 and held leadership roles of increasing significance, including serving as Segment President of Engine Systems, Segment President of Electronic Systems and Segment President of Engine & Safety Systems. Ms. Egnotovich served as a director of The Manitowoc Company from 2008 to 2016, where she was a member of its audit committee and served as the chair of its compensation committee. In February 2016, she became a director and chairpersonchairwoman of the board of The Manitowoc Food Service Company, a spinoff of The Manitowoc Company.

Key Attributes, Experience and Skills:

Company, subsequently renamed Welbilt, Inc. Ms. Egnotovich bringscontinues to be the Hexcelchairwoman of Welbilt’s board almost thirty years’ experience in the aerospace industry, muchand also serves as chair of which was in senior leadership roles. Ms. Egnotovich has significant experience overseeing and assessing the performance of companies, as well as their accountants, which makes her well-suited to serve on our auditits governance committee. In addition, Ms. Egnotovich is able to offer the board a different perspective based on her experience as a director of a publicly traded manufacturing company outside of the aerospace industry.

| Key Attributes, Experience and Skills: |

| Ms. Egnotovich brings to the Hexcel board almost 30 years of experience in the aerospace industry, much of which involved senior leadership roles. Ms. Egnotovich has significant experience overseeing and assessing the performance of companies, as well as their accountants, which makes her well suited to serve on our audit committee. In addition, Ms. Egnotovich provides to the board a useful manufacturing perspective, based on her experience as a director of a publicly traded manufacturing company outside of the aerospace industry. |

| THOMAS A. GENDRON |

W. KIM FOSTERChairman, Chief Executive Officer and President

Woodward, Inc.

Age:58

Director Since:2010

Committees:Compensation (Chair), 68, director since 2007, Lead Director

Position, Principal Occupation, Business Experience and Directorships:

From 2001 until October 2012, Mr. Foster served as Executive Vice President and Chief Financial Officer of FMC Corporation, a chemical manufacturer serving various agricultural, industrial and consumer

markets. Prior to serving in this role, Mr. Foster held numerous other executive and management positions with FMC, including Vice President and General Manager—Agricultural Products Group from 1998 – 2001; Director, International, Agricultural Products Group from 1996-1998; General Manager, Airport Products and Systems Division, 1991-1996; and Program Director, Naval Gun Systems, FMC Defense Group, from 1989 to 1991. Mr. Foster has been a director of Teleflex, Inc. since May 2013 and serves as the chair of its audit committee.

Key Attributes, Experience and Skills:

Mr. Foster has over 30 years’ management, operations and finance experience with FMC Corporation, including over eleven years as CFO, as well as experience as a director of another public company. He provides expertise and advice in the finance and investor relations areas, and his background in chemical operations has proven valuable in connection with discussions of capital spending and global sourcing. Mr. Foster’s many years of managing a large and geographically dispersed finance organization, his experience as the CFO of a publicly-traded company and his tenure as a member of the board of Hexcel led his fellow directors to appoint him as Lead Director starting in January 2014.Finance

THOMAS A. GENDRON, 56, director since 2010

Position, Principal Occupation, Business Experience and Directorships:

Mr. Gendron has been Chairman, Chief Executive Officer and President of Woodward, Inc., a designer, manufacturer and service provider of energy control and optimization solutions used in global infrastructure equipment, serving the aerospace, power generation and distribution and transportation markets, since 2007. Mr. Gendron wasHe previously served Woodward as President and Chief Executive Officer of Woodward from 2005 to 2007 and as President and Chief Operating Officer from 2002 to 2005. Prior to becoming President of Woodward, Mr. Gendron served in a variety of other management positions at Woodward.

Key Attributes, Experience and Skills:

Mr. Gendron’s experience as president and CEO

| Key Attributes, Experience and Skills: |

| Mr. Gendron’s experience as Chief Executive Officer and President of Woodward includes extensive operations and marketing experience in the aerospace and wind power industries, by virtue of Woodward’s global aircraft and wind turbine controls business. Mr. Gendron’s experience enables him to provide valuable insights regarding the aerospace and wind power industries, including marketing strategies. In addition, Mr. Gendron’s significant manufacturing management experience enables him to provide useful observations regarding our manufacturing operations. His experience in evaluating compensation programs as Woodward’s Chief Executive Officer renders him well-qualified to serve as chair of the compensation committee, and he has served in that capacity since May 2016. |

| 4 |  | HEXCEL CORPORATION | 2019 Proxy Statement |

PROPOSAL 1—Election of Woodward, a NASDAQ-listed company, includes extensive operations and marketing experience in the aerospace and wind power industries. Woodward’s global aircraft and wind turbine controls business enables Mr. Gendron to provide the board with insight as to the aerospace and wind power industries, and offer guidance on the development of marketing strategies. In addition, Mr. Gendron’s significant manufacturing management experience makes him well-suited to advise our operations team. His experience evaluating compensation programs as a CEO led to his appointment as chair of the compensation committee in 2016.Directors

| JEFFREY A. GRAVES |

JEFFREY A. GRAVESChief Executive Officer and President

MTS Systems Corporation, 55, director since

Age:57

Director Since:2007

Committees:Compensation, Finance

Position, Principal Occupation, Business Experience and Directorships:

Since May 2012, Dr. Graves has served as Chief Executive Officer, President and Presidenta director of MTS Systems Corporation, a leading global supplier of test systems and industrial position sensors. From 2005 until May 2012, Dr. Graves served as President and Chief Executive Officer of C&D Technologies, Inc., a producer of electrical power storage systems. From 2001 to 2005 he was employed by Kemet Corporation as Chief Executive Officer (2003 to 2005)(2003-2005); President and Chief Operating Officer (2002-2003); and Vice President of Technology and Engineering (2001-2002). From 1994 to 2001, Dr. Graves was employed by the General Electric Company, holding a variety of management positions in GE’s Power Systems division from 1996 to 2001, and in theGE’s Corporate Research and Development Center from 1994 to 1996. Prior to General Electric,Earlier, Dr. Graves was employed by Rockwell International and Howmet Corporation, now a part of Alcoa Corporation. Dr. Graves is

alsoSince 2017, he has been a member of the board of directors of MTS Systems CorporationFARO Technologies, Inc. and Teleflex, Inc. Dr. Graves serves on Teleflex’sits audit, compensation committee.and governance and nominating committees. He was a member of the board of directors of C&D Technologies, Inc. from 2005 through 2012.

Key Attributes, Experienceuntil 2012, and Skills:

Dr. Graves has more than ten years’ experience as a CEO of three NYSE-listed companies and substantial experience as a director of other US public companies. Dr. Graves has significant global operations and R&D experience, including with GE,Teleflex Incorporated from 2007 until 2017. He holds a PhD in Materials Science and has extensive prior involvement in materials development and application processes for airframe, propulsion systems and energy fields. In addition to the obvious value as an experienced CEO of three public companies, Dr. Graves was recruited to the board to help provide additional technical expertise. He has extensive experience doing business in China and India, enabling him to provide valuable contributions to discussions related to our Asia Pacific strategy, particularly with respect to industrial markets. Dr. Graves regularly reviews our R&D programs and organization and reports back to the board his findings and recommendations. In addition, Dr. Graves has advised on information technology projects based on his past experience with the implementation of enterprise resource planning systems.

| Key Attributes, Experience and Skills: |

| Dr. Graves’ extensive experience in executive and management roles with companies engaged in manufacturing and development enables him to share valuable perspectives on manufacturing, engineering, operations and finance matters. Dr. Graves provides valuable insights with respect to our global marketing efforts and strategic initiatives as a result of his significant experience with respect to international market development, particularly in China and India. Moreover, Dr. Graves’ PhD in Materials Science, with extensive experience in aerospace airframes and propulsion, together with his research and development experience, enables him to make significant contributions to the board’s assessment of our research and technology programs and information technology. In particular, he participates in our annual research and technology strategy meeting and provides an assessment to the board on the strategic direction of our product and technology development. Finally, his experience in energy storage facilitates robust discussion by the board on new market opportunities with alternative energy. |

| GUY C. HACHEY |

GUY C. HACHEY,61, director since Retired President and Chief Operating Officer

Bombardier Aerospace, Inc.

Age: 63

Director Since:2014

Committees:Compensation

Position, Principal Occupation, Business Experience and Directorships:

From May 2008 to July 2014, Mr. Hachey served as President and Chief Operating Officer of Bombardier Aerospace, Inc. Prior to joining Bombardier in 2008, Mr. Hachey held numerous roles with Delphi Corporation, including the combined positions of Vice President, Delphi Corporation and President, Delphi Europe, Middle East and Africa, as well as Executive Champion for Delphi’s global manufacturing operations. Mr. Hachey began his career in 1978 with General Motors Corporation, where he held manufacturing and engineering leadership positions in Canada and the U.S.

Key Attributes, Experience and Skills:

Mr. Hachey’s six years’ experience as the President and Chief Operating Officer of a major aircraft manufacturer enables him to provide critical insight into Hexcel’s aerospace product offerings across the globe. In addition, Since January 2019, Mr. Hachey has significant experience overseeing global automotive manufacturing businesses and is able to offer a valuable perspective to discussions regarding our manufacturing operations, global manufacturing footprint, and industrial markets.

DAVID L. PUGH, 68, director since 2006

Position, Principal Occupation, Business Experience and Directorships:

Mr. Pugh served as the Chairman and Chief Executive Officer of Applied Industrial Technologies Inc., one of North America’s leading industrial product distributors, from October 2000 until October 2011. He was President and Chief Operating Officer of Applied from January 1999 to January 2000 and President and Chief Executive Officer of Applied from January 2000 to October 2000. Prior to joining Applied, Mr. Pugh was senior vice president of Rockwell Automation and general manager of Rockwell’s Industrial Control Group. Prior to joining Rockwell, Mr. Pugh held various sales, marketing and operations positions at Square D. Co. and Westinghouse Electric Corp. Mr. Pugh is alsobeen a member of the board of directors of NN, Inc.Meggitt PLC, a British company whose shares are listed on the London Stock Exchange, and is a member of its audit, remuneration and nominations committees.

| Key Attributes, Experience and Skills: |

| Mr. Hachey’s six years’ experience as the President and Chief Operating Officer of a major aircraft manufacturer enables him to provide valuable insights with regard to Hexcel’s aerospace product offerings throughout the world. In addition, Mr. Hachey’s significant experience in overseeing global automotive manufacturing businesses enables him to provide valuable perspectives regarding our manufacturing operations and industrial markets. |

| HEXCEL CORPORATION | 2019 Proxy Statement |  | 5 |

PROPOSAL 1—Election of Directors

| CATHERINE A. SUEVER |

Executive Vice President – Finance and Administration and Chief Financial Officer

Parker Hannifin Corporation

Age:60

Director Since:2018

Committees:Audit

Ms. Suever has served as Executive Vice President—Finance and Administration and Chief Financial Officer of Parker Hannifin Corporation, a leading worldwide manufacturer of motion and control technologies and systems, since April 2017. Ms. Suever joined Parker Hannifin in 1987 and has held roles of increasing responsibility since, including Vice President and Corporate Controller from 2010-2017; Vice President and Controller, Climate & Industrial Controls Group from 2008-2010; Assistant Treasurer in 2007; and Director, Finance and Investor Relations Support in 2006. She has also served Parker Hannifin as Manager of External

Reporting and as a Division Controller and Business Unit Manager for its Gas Turbine Fuel Systems Division. Ms. Suever serves on its auditthe Board of Trustees for the National Multiple Sclerosis Society’s Ohio Buckeye Chapter. She is also a member of the CFO Council of the Manufacturers Alliance for Productivity & Innovation (MAPI), the American Institute of Certified Public Accountants (AICPA), and compensation committees.

Key Attributes, Experience and Skills:

Mr. Pugh was CEO of an NYSE-listed company for eleven years until his retirement in 2011. Throughout his career, he gained extensive operations and sales and marketing experience in large-scale global manufacturing organizations; and extensive experience as a director of public companies. Mr. Pugh’s expertise in factory control systems and equipment maintenance programs has provided valuable expertise to the board and to our operations management team. Mr. Pugh brings important perspectives in the executive compensation area to both the compensation committee and the board, as a result of his varied experiences with other public boards.Financial Executives International (FEI).

| Key Attributes, Experience and Skills: |

| Ms. Suever’s extensive experience in finance and accounting enables her to contribute significant financial acumen to the board and provide expertise and advice in compliance, risk management and finance. Moreover, her investor relations experience enables her to provide valuable perspectives regarding communications with the investor community. |

| THE BOARD OF DIRECTORS RECOMMENDS A VOTEFOR ELECTION OF EACH OF THE NOMINEES FOR DIRECTOR. |

| 6 |  | HEXCEL CORPORATION | 2019 Proxy Statement |

PROPOSAL 1—Election of Directors

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR

ELECTION OF EACH OF THE NOMINEES FOR DIRECTOR

We currently have ten independent directors out of eleven directors.

Our board affirmatively determined that each director nominee, other than our Chief Executive Officer and President, Mr. Stanage, meetsis independent within the NYSE director independence requirements.meaning of the listing standards of the NYSE. In making these determinations ouraddition, the board considered whether a director has a “material relationship” with us as contemplated bydetermined that the members of the audit committee, compensation committee and nominating and corporate governance committee are independent within the meaning of the NYSE listing standards. Onenon-employee director has a relationship with us other than as a directorstandards, and that members of Hexcel.the audit and compensation committees meet the additional independence requirements of the NYSE applicable to audit committee and compensation committee members. In making its independence determinations, the board considered the following: Ms. Brubaker is a non-employee director of a private aerospace company that is our customer. In determining thatcustomer; Ms. Brubaker did not haveand Dr. Graves are both non-employee directors of a material relationship with us,company that is our supplier; Mr. Campbell is a non-employee director of a company that provides consulting services to us; and thus was independent, our board considered,Mr. Hachey is a non-employee director of a company that is both a customer and a supplier of ours. After considering, among other things, theour sales to this private aerospaceeach company that is a customer as a percentage of our total sales, our purchases of goods or services from each company that is a supplier or service provider as well asa percentage of such company’s total sales (or projected sales for 2018), and the fact that Ms. Brubaker, isMr. Campbell, Dr. Graves and Mr. Hachey are not an employeeemployed by the companies referenced above, the board concluded that our relationships with these companies do not impair Ms. Brubaker’s, Dr. Graves’, Mr. Campbell’s or Mr. Hachey’s independence. In making the independence determination with respect to Dr. Graves and Ms. Suever, the board considered that they are executive officers of this private aerospace company and doescompanies that are our suppliers. After considering, among other things, thede minimisamount of purchases we made from these companies as a percentage of their respective total sales, the board concluded that our relationships with these companies do not have any significant directimpair Dr. Graves’ or indirect pecuniary interest in the business relationship between us and this private aerospace company.Ms. Suever’s independence.

Meetings and Standing Committees of the Board of Directors

During 20162018, there were fivenine meetings of the board, and 2118 meetings and six actions by written consent in the aggregate of the four standing committees of the board. Each of the incumbent directors who served on the board and its committees during 20162018 attended or participated in at least 75% of the aggregate number of board meetings and applicable committee meetings held during 2016.2018. A director is expected to regularly attend and participate in meetings of the board and of committees on which the director serves, and to attend the annual meeting of stockholders. Each of the incumbent directors other than Mr. Foster attended the last annual meeting of stockholders.

The board has established the following standing committees: audit committee; compensation committee; finance committee; and nominating and corporate governance committee. The board may establish other special or standing committees from time to time. Members of committees serve at the discretion of the board. Each of our four standing committees operates under a charter adopted by the board. The charter for each committee except the finance committee requires that all members be independent as required by NYSE listing standards. The charter of the finance committee prohibits the committee from taking any action that is required by NYSE rules to be taken by a committee composed entirely of independent directors, unless the finance committee is composed entirely of independent directors. The finance committee is currently composed entirely of independent directors. Our board has also adopted a set of corporate governance guidelines. All committee charters and the corporate governance guidelines can be viewed onare available through the investor relations sectionInvestor Relations page of our website,www.hexcel.com,, under “Corporate Governance.” You may obtain a copy of any of these documents, free of charge, by directing your request to Hexcel Corporation, Attention: Vice President, Investor Relations, Manager, Two Stamford Plaza, 281 Tresser Boulevard, Stamford, CT 06901, telephone(203) 352-6826.

| HEXCEL CORPORATION | 2019 Proxy Statement |  | 7 |

PROPOSAL 1—Election of Directors

The table below provides information regarding the current membership of each standing board committee and meetingthe number of meetings held during fiscal year 2016:2018:

Name | Audit | Compensation | Nominating and Corporate Governance | Finance | Audit | Compensation | Nominating and Corporate Governance | Finance | ||||

Joel S. Beckman | Ö | Chair | n | Chair | ||||||||

Lynn Brubaker | Ö | Chair | n | Chair | ||||||||

Jeffrey C. Campbell | Chair | Chair | n | |||||||||

Cynthia M. Egnotovich | Ö | n | ||||||||||

W. Kim Foster | Ö | Ö | ||||||||||

Thomas A. Gendron | Chair | Ö | Chair | n | ||||||||

Jeffrey A. Graves | Ö | Ö | n | n | ||||||||

Guy C. Hachey | Ö | n | ||||||||||

David C. Hill | Ö | Ö | ||||||||||

David L. Pugh | Ö | Ö | n | |||||||||

| Catherine A. Suever | n | |||||||||||

Number of Meetings | 8 | 6 | 4 | 3 | 8 | 6 | 2 | |||||

Actions by Written Consent | 1 | — | 1 | 4 | — | 2 | 3 | 4 | ||||

The audit committee assists with the board’sboard in its oversight of the integrity of our financial statements, our exposure to risk and mitigation of those risks, our compliance with legal and regulatory requirements, our independent registered public accounting firm’s qualifications, independence and performance, and our internal audit function. Additional information regarding the audit committee, including additional detail about the functions performed by the audit committee, is set forth in the Audit Committee Report included on page 6364 of this proxy statement.

All members of our audit committee meet the financial literacy requirements of the NYSE and at least one member has accounting or related financial management expertise as required by the NYSE. In addition, our board has determined that Jeffrey C. Campbell isand Catherine A. Suever are each an audit“audit committee financial expertexpert” under SEC rules.

The audit committee has adopted procedures for the receipt, retention and handling of concernscomplaints regarding accounting, internal accounting controls and auditing matters by employees, stockholders or other persons. Any person with such a concerncomplaint should report it to the board as set forth under “Contacting the Board” on page 15.11. The audit committee has also adopted procedures for the confidential, anonymous submission by employees of concerns regarding questionable accounting or auditing matters.

The audit committee has established policies and procedures for thepre-approval of all services provided by our independent registered public accounting firm. These policies and procedures are described on page 65 of this proxy statement.

The finance committee provides guidance to the board and management on significant financialfinance matters, including the company’s capital structure, credit facilities, equity and debt issuances, acquisitions, divestitures, liquidity, dividends and share repurchases, and insurance coverage.

Nominating and Corporate Governance Committee

The nominating and corporate governance committee regularly seeks input from the board regarding the skills and attributes it believes new nominees should possess in order to strengthen the board; identifies and recommends to the board individuals qualified to serve as directors and on committees of the board; advises the

board with respect to board and committee procedures; develops and recommends to the board, and reviews periodically, our corporate governance principles; and oversees the evaluation of the board, the committees of the board and management. The nominating and corporate governance committee evaluates the board’s and each committee’s performance at least annually. In addition, eachthe nominating and corporate governance committee, in collaboration with the lead director, conducts an annual self-evaluation and we also conduct a peer review of individual directors every other year. The nominating and corporate governance committee has independent authority to select and retain anya search firm to assist it in identifying qualified candidates for board membership, and has the sole authority to approve the search firm’s fees and terms of engagement.

The

Under the charter of the nominating and corporate governance committee believes that each nomineeand our corporate governance guidelines, the nominating and corporate governance committee is responsible for assessing the appropriate balance of criteria required of board members and, in considering potential director should demonstrate, by significant accomplishment in his or her field, an ability to make a meaningful contribution tocandidates, will consider, among other things, the board’s supervisionbackground and oversightqualifications of our business and affairs. The committee also considers the following when selecting candidates for recommendation to the board: broad businesspotential director candidate, including knowledge,

| 8 |  | HEXCEL CORPORATION | 2019 Proxy Statement |

PROPOSAL 1—Election of Directors

experience, professional relationships, expertise, diversity, personal and professional integrity, character, business judgment, time availability in light of other commitments, dedication, potential conflicts of interest and such other factors that the nominating and corporate governance committee considers appropriate in the context of the needs or stated requirements of the board.

We do not have a formal policy with regard to consideration of diversity in identifying director nominees. However, both the charter of the nominating and corporate governance committee and our corporate governance guidelines list diversity as one of many attributes and criteria that the committee will consider when identifying and recruiting candidates to fill positions on the board. Our corporate governance guidelines also state that our board should generally have no fewer than ten directors to permit diversity of experience. The committee considers a broad range of diversity, including diversity with respect to experience, skill set, areas of expertise and professional background, as well as race, gender and national origin. Our informal policy regarding consideration of diversity is implemented through discussions among the committee members, and by the committee with our outside search firm and with senior management. The committee assesses the effectiveness of this policy through its annual self-evaluation, a report of which is delivered to the board. Every board candidate search undertaken by us includes diversity as a desired attribute for the candidate.

The nominating and corporate governance committee will consider director candidates recommended by stockholders, as well as by other sources including ournon-management directors, our chief executive officer, and other executive officers. In considering candidates submitted by stockholders, the committee will take into consideration the needs of the board and the qualifications of the candidate. The company’s policy oncandidate, according to the consideration of all director candidates, regardless of source, iscriteria set forth in the charter of the nominating and corporate governance committee.above. To have a candidate considered by the committee, a stockholder must submit the recommendation in writing to our corporate secretarythe Corporate Secretary at the address listed below under “Contacting the Board” so that it is received at least 120 days prior to the anniversary date of our prior year’s annual meeting of stockholders. The stockholder must supply the following information with his or her recommendation: